top of page

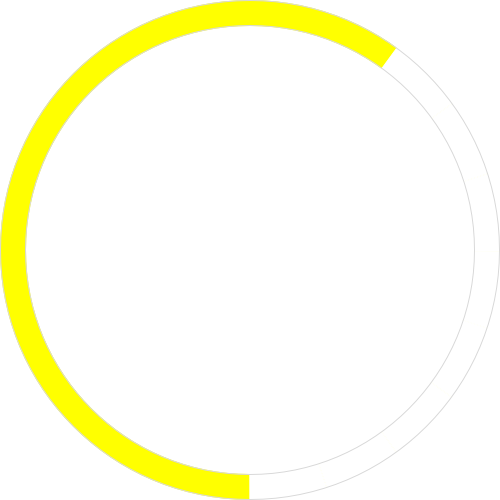

HOA SCORE

®

6.16

/10

Good

Monthly Dues may increase slightly and risk of Special Assessment is low.

HOA FINANCES

Good

Monthly Dues may increase slightly and risk of Special Assessment is low.

IMPACT ON OWNERS

Low

The ratio of Monthly Dues to estimated Mortgage Payment is low. Any increase in Monthly Dues or Special Assessments should have low financial impact.

What is HOA Score ?

®

It's like a credit score for an HOA... a lower HOA Score® means higher risk of dues increases and special assessments in future.

Derived from HOA financials and MLS Data.

what-is-hoa-score

SCORE BREAKDOWN

FISCAL YEAR ENDING

2022

MONTHLY PAYMENT

VS. SIMILAR ASSOCIATIONS (%)

'-10.31

CURRENT INCREASE (%)

'-1.99

LAST YEAR INCREASE (%)

0

DATA SOURCES

ADDRESS | MLS | DATE |

|---|---|---|

2046 Eva Street | 322086726 | 09/21/2022 |

2042 Eva Street | 322067237 | 07/16/2022 |

2172 Eva Street | 40981273 | 02/26/2022 |

2054 Eva Street | 322003231 | 01/18/2022 |

2244 Eva Street | 22021291 | |

2159 Eva Street | 22020926 | |

2260 Eva Street | 22013480 | |

2082 Eva Street | 21727329 | |

2232 Eva Street | 321009559 | |

2066 Eva Street | 21812695 | |

2248 Eva Street | 22012043 | |

2252 Eva Street | 22029557 | |

2050 Eva Street | 321115054 | |

2086 Eva Street | 21912538 | |

2256 Eva Street | 21829990 | |

2187 Eva Street | 22026464 | |

2143 Eva Street | 22029049 | |

2164 Eva Street | 21924311 | |

2236 Eva Street | 22021208 | |

2195 Eva Street | 22003126 |

bottom of page